RESULTS is a movement of passionate, committed everyday people who use their voices to influence political decisions that will bring an end to poverty.

Empower people across the United States to raise their voices for proven solutions to poverty.

DonateAdd your name

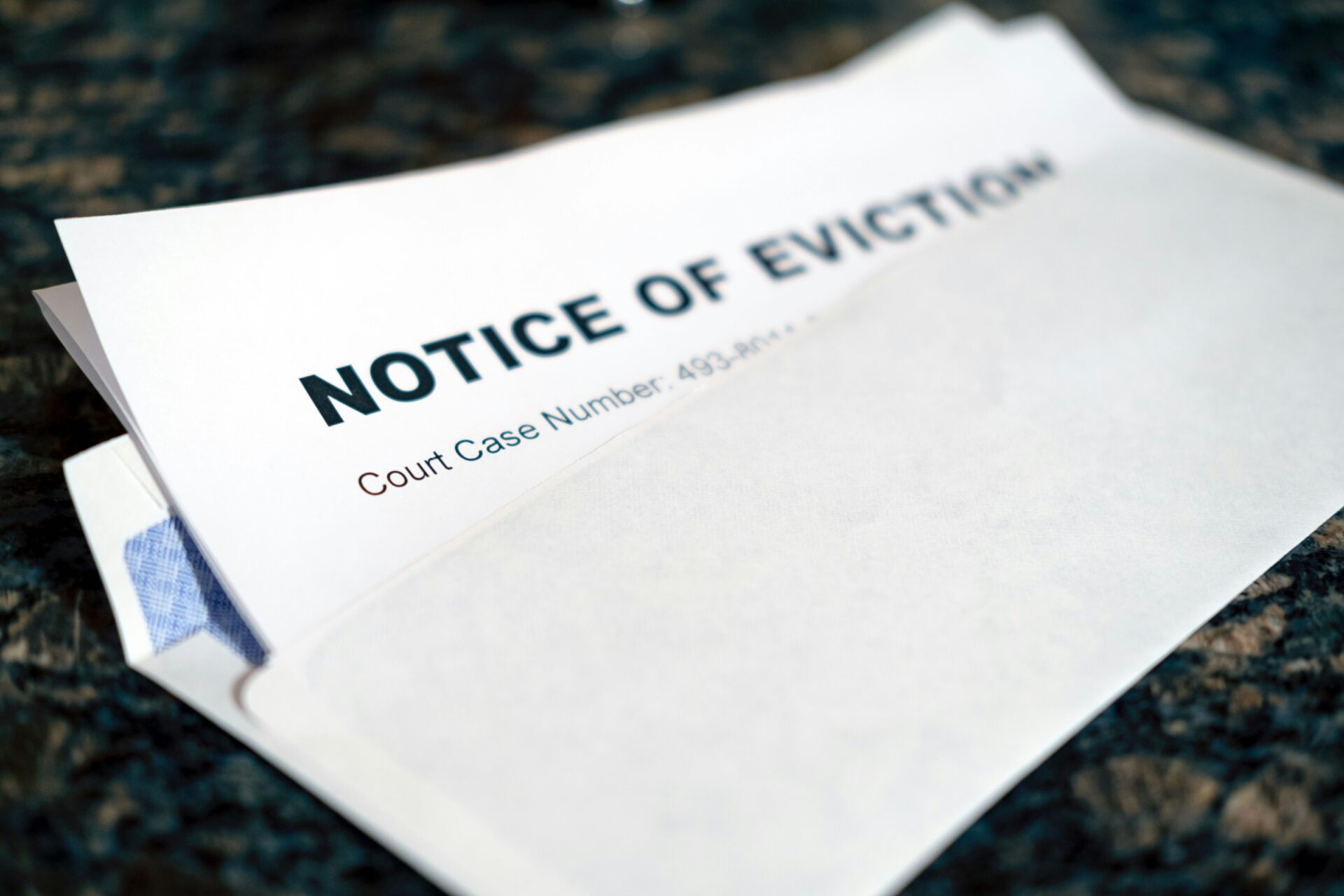

Make your voice heard! Stand with millions of people who are struggling with high rents and unaffordable housing.

Share your testimonyACTION

ACTION is a partnership of 15 locally rooted, independent organizations. They work together to increase resources and build political support for global health initiatives.

RESULTS Fellowship

The RESULTS Fellowship is an 11-month program designed for activists ages 20-35 to harness the power of their voice, sharpen their advocacy and organizing skills, and take action with dozens of other dynamic young leaders.

Experts on Poverty

RESULTS launched our Experts on Poverty program in 2015. The program includes a cohort of individuals with lived/living experiences of poverty from across the nation.